How to Insure a Lab Grown Diamond Ring: 5 Mistakes to Avoid

Insuring a lab grown diamond ring might seem simple, but getting it right takes a little more attention than most people expect. Many insurance companies now offer jewelry insurance that covers lab grown diamonds, but not all policies are created equal.

According to BriteCo, the average cost of jewelry insurance is about 1% to 2% of the item’s value per year — and that includes lab grown diamond jewellery.

If you’ve recently started buying lab grown diamonds or already own one, this guide will help you avoid the most common mistakes people make when trying to insure a lab grown piece the right way.

Why Is It Important to Insure a Lab Grown Diamond Ring?

You might think lab grown diamonds aren’t as valuable as natural diamonds — but that’s not true. A well-cut lab created diamond holds real financial value and sentimental meaning. And like real diamonds, they deserve protection.

According to BriteCo, lab grown diamond insurance typically costs 1%–2% of the ring’s value each year — but that cost is worth it when you think about what could go wrong. Even a replacement ring won’t carry the same emotional weight.

1. Real Value Protection

Lab diamonds may not have the same resale value as mined diamonds, but they’re still a significant investment. If lost or damaged, you’d have to pay the same price again. A proper policy ensures the ring is properly insured based on its appraisal value.

-

Reflects the true value of the ring

-

Can cover accurate valuation and insured value

-

Accounts for carat weight, cut, and quality

2. Covers Loss and Damage

A strong policy includes replacement coverage — and not just for theft.

-

Includes natural disasters, extreme heat, or accidental loss

-

Protects against mysterious disappearance

-

Keeps your insured items covered anytime, anywhere

3. Peace of Mind

Knowing you’re protected brings emotional comfort. Whether it’s travel or daily wear, your insurance provider should offer worldwide coverage.

-

Some policies offer offers worldwide coverage or blanket coverage

-

Trustworthy insurance companies provide financial protection

4. More Than Just Theft

Jewellery insurance isn’t only for break-ins. The right insurance purposes should provide coverage for unexpected issues that aren't obvious at first.

-

Includes replacement value, not just cash

-

Covers valuable items and valuable gemstones

5. Avoid Regret Later

Skipping insurance often feels harmless — until something happens.

-

Without it, you might lose your significant investment

-

Keep your purchase receipt and stay covered with appropriate coverage

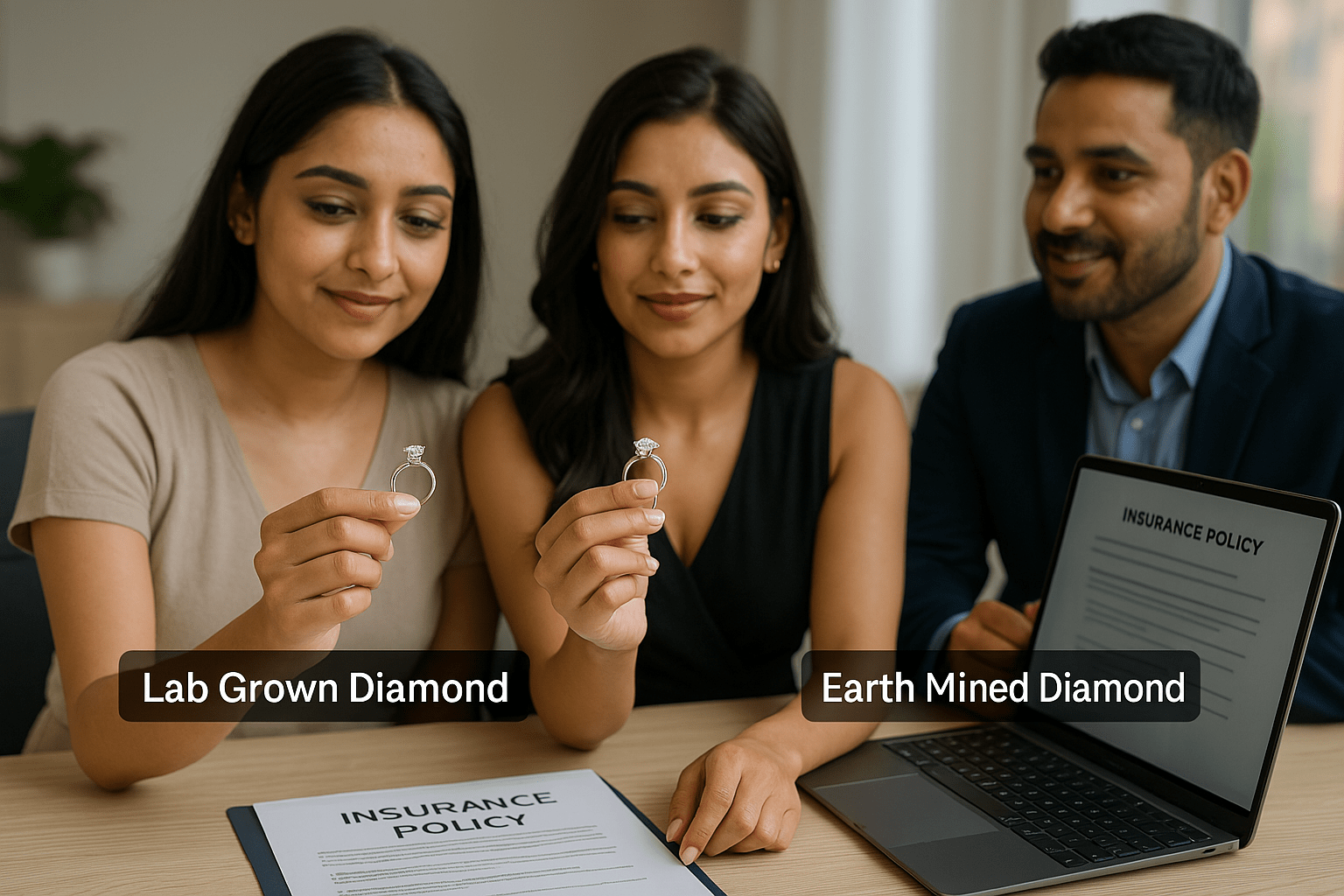

What’s the Difference Between Insuring a Grown Diamond and an Earth Mined Diamond?

Before you insure your lab grown diamond, it's smart to know how it compares to an earth mined diamond in the eyes of insurance companies. While both can be covered, there are some key differences in value, coverage preferences, and policy details that can affect your decision.

Sure! Here's the short intro paragraph followed by a clear comparison table for the section:

Before you insure your lab grown diamond, it's smart to know how it compares to an earth mined diamond in the eyes of insurance companies. While both can be covered, there are some key differences in value, coverage preferences, and policy details that can affect your decision.

| Factor | Lab Grown Diamond | Earth Mined Diamond |

|---|---|---|

| Perceived Value | May have lower resale value but still holds insured value | Holds higher market and resale value |

| Insurance Premiums | Often comes with lower premiums | May lead to higher premiums, especially in high-value cases |

| Replacement Coverage | Must confirm insurer will replace with a lab grown diamond | Usually replaced with another natural diamond |

| Certification Requirements | May need extra clarity; some insurers prefer IGI or GIA reports | Typically accepted with standard GIA certifications |

| Market Stability | More price fluctuations; needs regular appraisal updates | Stable valuation; appraisal less likely to shift rapidly |

| Emotional/Sentimental View | Often chosen for ethical or budget reasons | Often seen as a long-term luxury investment |

What are the Coverage Limits on Your Insurance Policy?

Many people don’t realise that standard policies often have coverage limits on jewellery. If your lab grown diamond insured ring is worth ₹1.5 lakhs but your coverage stops at ₹50,000, the rest comes out of your pocket. That’s why knowing your policy limits upfront really matters.

In India, home insurance sometimes includes jewellery, but often with very low limits unless specifically declared. So you need to ask your insurance provider what’s covered and how much.

What you should check:

-

Confirm if the insurer offers higher coverage limits for jewellery

-

Ensure your ring is appraised by a recognised lab like the International Gemological Institute (IGI)

-

Some Indian insurers may also refer to the Gemological Institute when evaluating diamond quality

"Always match the insurance to the ring’s actual worth — don’t go by guesswork," say experts at Policybazaar.

What Do Insurance Companies Cover for Lab Grown Diamond Rings?

Beyond the usual policies, there are a few lesser-known ways to protect your lab grown diamond ring. While they might not offer complete protection on their own, they can be helpful when used alongside a primary insurance plan.

| Type | Covers Loss/Theft? | Full Replacement? | Good For |

|---|---|---|---|

| Home/Renters Add-On | Sometimes | Limited | Budget-friendly basics |

| Standalone Jewelry Insurance | Yes | Yes | Full coverage + peace of mind |

| Personal Articles Policy | Yes | Yes | Higher limits & flexibility |

| Retailer Warranty | No | No | Repairs/maintenance only |

| Credit Card Protection | Partial | No | Short-term coverage post-purchase |

| Travel Insurance | Limited | Rarely | Temporary trip-related coverage |

| Umbrella Insurance | Conditional | Yes (sometimes) | High-net-worth or bundled assets |

Insurance Coverage Tips You Should Know Before Buying Lab Grown Diamonds

Buying lab grown diamonds isn’t just about selecting the right cut or carat weight. It’s also about protecting that purchase from day one. Whether it’s an engagement ring or a personal investment, insurance coverage matters more than most people think.

1. Get a Certified Appraisal

Before insuring, make sure your lab grown diamond comes with a professional appraisal from a reputed lab.

-

A report from the International Gemological Institute (IGI) is widely accepted in India.

-

This helps ensure accurate valuation and prevents disputes later.

"An IGI certificate can make your insurance process smoother and your claim stronger," says a senior underwriter at HDFC ERGO.

2. Ask for Written Documentation

Always request a printed or digital insurance policy document that outlines the coverage limits.

-

Double-check that it clearly states you're insuring a lab grown diamond.

-

This avoids confusion with natural diamonds during claims.

3. Check Policy Start Dates

Some insurance companies delay coverage start until after processing is complete.

-

Ask your insurance provider when the policy actually begins.

-

This helps avoid uncovered periods right after purchase.

4. Insure Immediately After Purchase

It’s best not to wait. The sooner you insure your diamond, the better.

-

Even temporary risks like travel or moving can lead to loss or damage.

-

Early coverage also protects against mysterious disappearance, which many policies cover if declared early.

5. Keep Proof of Ownership Safe

Hold onto your purchase receipt, certificates, and any policy communication.

-

These documents are vital if you ever file a claim.

-

Store them digitally and physically for easy access when needed.

Insurance isn’t just for high-end natural diamonds. When you’re buying lab grown diamonds, taking the right steps early means your jewelry is not just beautiful — it’s protected with purpose.

What Are the Biggest Mistakes to Avoid When Choosing Insurance Policies?

Choosing the right policy for your lab grown diamond isn’t just a formality — it affects how much protection you really have. A small oversight now could make a big difference if you ever have to file a claim. Let’s walk through the common mistakes and how you can steer clear of them.

1. Choosing the Wrong Insurance Provider

Not every insurer understands the value of lab grown diamonds. Some may even treat them differently than natural diamonds. That’s why choosing the right insurance provider is key.

How to avoid it:

-

Check if the insurer explicitly covers lab grown diamond jewellery

-

Look for companies that work with IGI or Gemological Institute reports

-

Compare offerings from many insurance companies — don’t settle for the first quote

2. Ignoring Coverage Limits

Coverage limits define the maximum payout you’ll receive — and if it's too low, you’ll bear the loss. This is especially important if your ring’s insured value is higher than the default limit.

How to avoid it:

-

Ask about higher coverage limits for valuable items

-

Ensure the policy reflects your accurate valuation

-

Review if valuable gemstones are treated differently

3. Skipping the Fine Print

Policy documents are long, but skipping them can cost you. Important details like mysterious disappearance clauses or replacement coverage are often tucked in.

How to avoid it:

-

Always read the policy document before signing

-

Highlight terms like natural disasters and replacement ring eligibility

-

Don’t assume — confirm everything in writing

4. Not Asking the Right Questions

Many people avoid asking questions and later regret it. If you're not sure what’s covered, ask — it’s your right.

How to avoid it:

-

Ask if your policy includes worldwide coverage

-

Confirm if it covers both theft and accidental damage

-

Understand what documents you’ll need to make a claim

5. Delaying the Insurance Process

The longer you wait, the more you're at risk. Insurance isn’t retroactive — and delays often mean uncovered damage.

How to avoid it:

-

Insure your lab grown diamond as soon as you purchase it

-

Get a professional appraisal right away

-

Keep your purchase receipt safe for easy documentation

Choosing the right policy doesn’t need to be stressful — just informed. Stick to the essentials, ask questions, and insure smart.

Can Engagement Rings Be Covered Under Home Insurance?

Yes, engagement rings — including lab grown ones — can be covered under your home insurance, but there’s a catch. Most standard home insurance policies in India include jewellery under “personal belongings,” but the coverage limits are usually very low. In many cases, it’s capped between ₹50,000 and ₹1,00,000.

What home insurance does (and doesn’t) cover

It may cover basic things like fire or theft, but not if you lose the ring, drop it, or it disappears mysteriously. Plus, insurers might deduct depreciation or not replace the ring with one of equal value.

Why a separate policy might be smarter

If your ring is worth more — and most are — a standalone jewelry insurance policy gives you wider protection. It can cover accidental loss, worldwide coverage, and even full replacement value.

-

You won’t have to depend on the same claim limits as furniture or electronics

-

It ensures your ring — especially a lab grown diamond — is treated with the value it deserves

-

Claims don’t affect your home insurance premiums

It’s peace of mind, the way it should be.

FAQs

1. How much does it cost to insure a lab grown diamond ring?

On average, it costs 1% to 2% of the ring’s value per year. So, if your lab grown diamond is worth ₹1,00,000, you’re looking at around ₹1,000 to ₹2,000 annually. The final premium depends on your ring’s value, location, and chosen coverage limits.

2. Does Jewelers Mutual insure lab-grown diamonds?

Yes, Jewelers Mutual does cover lab grown diamonds. Just make sure your appraisal clearly mentions it's a lab created diamond, so there's no confusion during a claim.

3. Can a jeweler detect a lab grown diamond?

Yes — but not with the naked eye. Reputed jewelers use advanced tools and certifications, often from labs like IGI or GIA, to identify whether it’s lab grown or mined.

4. Is it worth insuring a lab grown diamond ring?

Absolutely. Even if it's not a natural diamond, it’s still a significant investment. Insurance offers peace of mind — and covers loss, theft, and more.

Conclusion

Insuring your lab grown diamond ring isn’t just a smart move — it’s peace of mind you’ll be glad you have. Now that you know what mistakes to avoid, what to look for in coverage, and how to get started, you’re in a much better place to protect what matters.

Whether it’s an engagement ring or a personal buy, don’t leave it to chance. Ask the right questions, choose the right provider, and get that coverage in place. You’ve invested in something meaningful — now it’s time to insure it right.